Foreword

Key Findings

Image text: 74% of small businesses said they had to engage with social distancing measures for customers and/or staff.

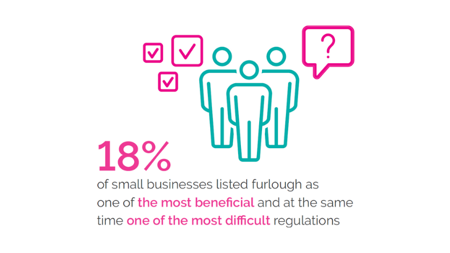

Image Text: 18% of small businessses listed furlough as one of the most beneficial and at the same time one of the most difficult regulations

Image Text: 66% of businesses in the hospitality, food and beverage sector found they had to take considerable action to make their premises COVID-secure

Image Text: 35% of small businesses found it either quite difficult or very difficult to understand the implications of regulations/guidance in relation to the COVID-security of their business

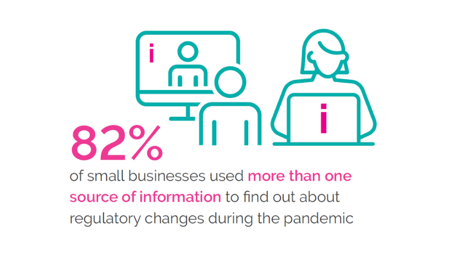

Image Text: 82% of small businesses used more than one source of information to find out about regulatory changes during the pandemic

Image Text: 22% of businesses thought the distinction between regulations enforceable by law and non-mandatory government guidance was 'totally unclear'

Recommendations

Governments across the UK should seek to minimise the restrictions imposed on small businesses in order that they can qualify for schemes designed to support businesses. When thinking about how best to reduce compliance burdens in the future, it is important to not only consider regulations that businesses must comply with, but also to avoid unnecessary qualifying criteria being applied to beneficial schemes that businesses might choose to apply for. Furlough was potentially one of the most beneficial regulations for those small businesses with employees, but also one of the most difficult. At the outset, with the binary choice of furloughing employees for a minimum of three weeks or paying their full wages, some businesses faced the stark choice of missing out on revenue-generating work or incurring full wage costs for an employee. The introduction of flexible furlough removed this binary choice, better reflecting the needs of small employers.

UK Government should ensure any future income support scheme for small businesses is flexible from the outset and additionally should ensure directors who draw income from running their business via dividends are treated in-line with the self-employed. A Directors’ Income Support Scheme (DISS), proposed by FSB and partners and founded on the principles underpinning the Self-Employment Income Support Scheme, could have been established based on the trading profits of the company.

Not all employees can work from home, therefore the UK Government should promote other forms of flexible working arrangements. Hybrid working cannot be undertaken by all small businesses including many of those in hospitality and childcare, and adopting a range of practices (e.g. staggered hours) would enable all sectors and employees to benefit from a greater adoption of flexible working in the labour market.

The Help to Grow (Digital) scheme should be expanded to organisations with fewer than five employees and provide access to a wider range of software. Regulatory and legal changes during the pandemic have only increased the importance of having a digital presence, with digital skills and capability being fundamental to a business’s ability to react to legal and regulatory changes. The Help to Grow (Digital) scheme provides vouchers which can be used to invest in digital technologies. This scheme should be extended in scope, so that businesses with fewer than five employees can use the vouchers to invest in a wider range of software.

The UK Government should establish a taskforce of Ofcom, devolved bodies, suppliers and business groups to develop temporary and affordable solutions that address the slow and unreliable broadband connection in very hard to reach areas while Gigabit capable broadband is rolled out across the country until the end of the decade. The UK Government should also undertake its own nationwide awareness-raising activities of the benefit of gigabit-capable broadband. It should establish and lead a coalition of key stakeholders to work together on a national campaign. In addition, mobile coverage in hard-to-reach areas must be addressed.

Governments across the UK should evaluate the impact of the actions taken during the pandemic in respect of regulation, and draw up a contingency plan. A wide range of public health restrictions and business support measures were rolled out at different times during the pandemic, at a speed that meant the normal impact assessment was simply not possible. Now is the time to evaluate those impacts, so that if a similar event should happen again there are clear plans and communication channels in place so that this action can be understood by the wider community.

Governments and regulators across the UK should publish illustrative examples of compliance when regulating small businesses. This would include the individual steps and time scales in which a business could become compliant. This helps show small businesses the journey to compliance, and the timescales indicate which changes are required immediately, and which can be done in time. These illustrative examples would give small businesses examples of how they could choose to comply with the regulations, without fettering the scope for flexibility that many small businesses desire. It should be made clear in each illustrative example which are the mandatory steps, and which are discretionary.

Governments and regulators across the UK should, whenever changing or introducing new regulations, draw clear distinctions between the actions that a business must take to comply with regulatory changes, and the steps that a business might choose to take. This should be done by introducing a “red list” at the top of guidance documents setting out which actions must be done, where in the UK this applies, and with further detail later in the document. Additionally, in respect of any optional steps suggested, it should be made clear that these are not part of the regulations and requirements, and as such a business would not be found to be in breach of the regulations for not following them. This distinction would allow small businesses to make informed choices about whether to go beyond minimum compliance levels, while avoiding the risk of gold-plating due to uncertainty.

Governments and regulators across the UK should avoid making guidance documents unnecessarily lengthy and ensure that they pass a plain English language test. Where regulatory documents are produced in different languages for the respective devolved nations, simplicity should be the guiding principle. This means that, regardless of which of the UK’s languages businesses use, they should be able to understand what is required of them. These guidance documents should ideally be produced in conjunction with intermediaries (such as business representative organisations and sector specific organisations).

Whilst it is impossible to account for each and every individual business circumstance and situation created by new regulations or regulatory change, Governments and regulators across the UK should include an FAQ document within new regulations and regulatory changes designed to address common questions. This would also include where business groups have asked for further clarity or identified common questions among the business community.

Governments and regulators across the UK should set up a “regulation request” inbox for the first year of any new regulations, so that businesses can email in queries, which can then be responded to or used as a point of signposting towards useful documentation. The most common queries can then be used to better update the guidance and future regulations.

Unless safety critical, Government and regulators should always allow a grace period after a regulatory change is introduced before enforcement action will be taken. Ideally, this would take the form of a standard six-month grace period automatically applied to new regulations unless it can be shown that there is a safety critical requirement. When enforcement begins, it should be soft touch, encouraging compliance rather than punishing mistakes. Clearly, while circumstances during the pandemic required rapid regulatory change, there is a learning point that small businesses would be more confident in their compliance approach if they knew that they would not face immediate enforcement activity on Day 1 of a regulatory change. During this grace period, regulators could assess compliance levels and reach out to offer advice and support to small businesses.

Governments and regulators across the UK should design and implement appropriate consultation processes with intermediary bodies as part of communication plans when key regulations are changing. Many small businesses chose to use a range of sources when finding information about regulatory changes during the pandemic, including informal sources (e.g. social media news feeds and online groups). Where government bodies or regulators can engage early on upcoming regulatory changes with intermediary bodies (like business representative bodies, sector-specific regulators, or trade associations) and work with them in the design of the guidance, it allows those intermediary bodies to produce tailored guidance much faster, ensuring that there is another source of information on the steps needed to comply. This is critically important in devolved nations. Using intermediaries such as Business Wales, Business Gateway in Scotland or NI Business Info can help business draw that distinction between regulations which apply differently in each nation. This early engagement could also take the form of a confidential consultation on the regulatory changes themselves, even in the context of a fast-moving pandemic, and must avoid simply using intermediaries to disseminate Government guidance or as simply an email list.

Government and regulators should always pursue a culture of regulation that emphasises proportionate, appropriately communicated regulation that acknowledges the differential needs and regulatory experiences of different types and sizes of small business. All governments across the nations of the UK should be considering how to take forward their frameworks for better regulation. For example, the UK Government is currently re-evaluating its approach to regulation in light of the UK’s departure from the European Union, and it will be important to ensure that the burden of regulation on small businesses continues to be rigorously assessed and minimised. The 2001 Northern Ireland Better Regulation Strategy, although welcome, is in great need of modernisation and should be reviewed, refreshed and republished. Additionally, the Northern Ireland Executive should legislate to ensure that the Small and Micro Business Impact Test (SAMBIT) is used across all Northern Ireland departments when developing new policy and regulations.

Download the full report

Click below to download the full report including full methodology and references.