This content was reviewed in September 2024.

What is employee ownership?

Employee-owned businesses are wholly or significantly owned by employees. Staff must have a financial stake in the business, often through Share Incentive Plans (SIPs) and a say in how the business is run. Well-known examples of businesses using this model include department store John Lewis and entertainment retailer Richer Sounds. According to the Employee Ownership Association, they contribute up to £42bn a year to the UK economy.

How does it work?

There are three types of employee ownership: direct, indirect, or a combination of the two. In direct ownership, employees become individual shareholders in the company using tax advantaged share plans. Indirect ownership involves shares held on behalf of the employees through an employee trust. You may need to change the legal structure of your business to sell shares to your employees, for example, if you’re a sole trader.

Employee engagement could take the form of a consultation group, employee directors on the board or working with trade unions, depending on your business.

The government has detailed guidance you can refer to for more information.

Why would I sell my business to my employees?

When you’ve built a business from the ground up, you might be wondering: why would you sell it to your employees? However, there are many stages in the business lifecycle where employee ownership may be relevant or could even help your business to survive and thrive.

1. Growing your business

For businesses looking to expand, employee ownership can be attractive to potential hires, helping you to employ more talented individuals.

2. Starting as you mean to go on

New businesses can opt for employee ownership from the get-go and integrate the structure into their ethos and mission.

3. Business succession

If you’re looking to sell your business or pursue new challenges, you may consider selling to employees as they already know your business.

4. Insolvency

Employee ownership is one of the options you might consider if you’re faced with questions about your business’ future.

What are the benefits of employee ownership?

There are upsides for both you and your team when considering employee ownership.

- Higher productivity as staff are invested and have a voice

- Increased employee engagement and motivation

- Lower staff turnaround and improved retention of talent

- More control over the sale of your business

- Team are recognised for their contributions and commitments

For information about the tax benefits of employee ownership, HMRC has an in-depth introductory guide regarding the Employee Share Trust.

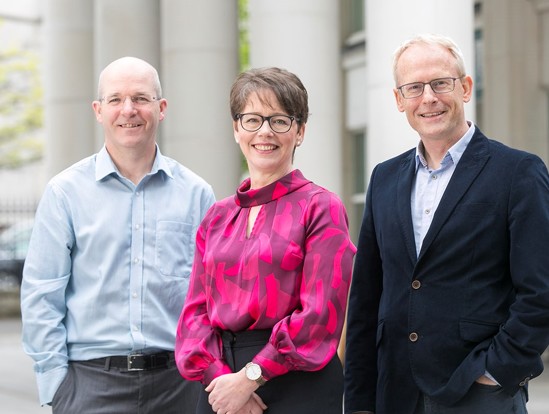

Employee Ownership: Joan McCoy, White Ink Architects

We sat down with Joan McCoy, long-time FSB member and Director of White Ink Architects, to learn more about the company’s transition to the first wholly Northern Ireland based employee-owned consultancy.

Employee Ownership: Neil Wright, TensCare

How Neil Wright and his company embraced employee ownership and the benefits it brought for both staff and the business.

More questions?

FSB members can call our 24/7 legal advice line and there is also a detailed guide to employee ownership available on FSB Legal and Business Hub.

- Employee Ownership Association helps businesses in the UK become employee owned.

- Co-operative Development Scotland

- Wales Co-operative Centre

- NI Business Info